From the formula above, we see that ordering the higher quantity would bring our inventory costs down to $61,515—a $1,485 savings. Now, the example we used above is pretty simplistic—and unfortunately, calculating real-life inventory costs is rarely that easy. By optimizing order quantities for various components, the manufacturer can reduce storage costs, minimize production interruptions, and maintain efficiency. Lead time demand means the amount of demand you anticipate the product will have between now and when the delivery will arrive to replenish your stock.

What are the Importants of Economic Order Quantity?

Understanding your business’s EOQs is crucial for creating a positive customer experience and saving your company money on inventory costs. Economic order quantity is important because it helps companies manage their inventory efficiently. Without inventory management techniques such as these, companies will tend to hold too much inventory during periods of low demand while also holding too little inventory during periods of high demand. The supplier also has the minimum quantity per order, which depends on other factors such as the nature of material, size and safety. Placing order outside of supplier standard may result in additional cost, and it may not possible. For example, consumer goods producers require well-balanced inventories at the point of sale.

EOQ is an important cash flow tool for management to minimize the cost of inventory and the amount of cash tied up in the inventory balance. For many companies, inventory is the largest asset owned by the company, and these businesses must carry sufficient inventory to meet the needs of customers. If EOQ can help minimize the level of inventory, the cash savings can be used for some other business purpose or investment. Economic order quantity (EOQ) is the ideal order quantity a company should purchase for its inventory given a set cost of production, a certain demand rate, and other variables. When it comes to inventory management, knowing what you’ve got, where it is, and how much of it you have on hand is absolutely essential. This knowledge is key to practicing proper inventory control, the balancing act of stocking just enough inventory to meet customer demand without sacrificing profitability.

Clients of industrial and commercial producers usually do not require the same degree of delivery lead time. Smaller businesses also face financial and logistical limitations when starting their inventory systems, so it’s key that you choose the most effective method that suits your organisation. Unfortunately, ordering such a low quantity of bags at a time means you have to place more orders throughout the year, which means you pay the $100 purchasing fee more often.

Cut Costs and Streamline Your Supply Chain Process

There is also a cost for each unit held in storage, commonly known as holding cost, sometimes expressed as a percentage of the purchase cost of the item. Although the EOQ formulation is straightforward, factors such as transportation rates and quantity discounts factor into its real-world application. To minimize its inventory carrying costs, a company must place small orders. But small order size means that the company must place more orders which increases its total ordering costs.

Leveraging EOQ for Optimized Inventory Control

When you do the math, you find that ordering fewer units basics of business accounting at a time brings your total cost down to $63,000. Malakooti (2013)10 has introduced the multi-criteria EOQ models where the criteria could be minimizing the total cost, Order quantity (inventory), and Shortages. Additionally, the economic order interval8 can be determined from the EOQ and the economic production quantity model (which determines the optimal production quantity) can be determined in a similar fashion. Perera et al. (2017)4 establish this optimality and fully characterize the (s,S) optimality within the EOQ setting under general cost structures. FreshBooks expense-tracking software solutions help businesses organize their receipts and spending and automatically track and categorize inventory expenses. This gives company owners the data they need to analyze their spending and profits, with no manual entry required.

Improve cash flow

The EOQ helps you strike the perfect balance, ensuring you have enough stock without becoming a hoarder. Notice that the quantity of 400 units with 6 annual orders and a combined ordering and holding cost of $120 is the most economical quantity to order. Other order quantities that result in more or less than six orders per year are not so economical. The ordering costs are the costs that are incurred every time an order for inventory is placed with the supplier.

Safety stock is the amount of extra inventory you keep on hand to ensure you don’t run out. Determining the correct amount of inventory requires you to estimate needs based on historical demand. This can be time-consuming if you’re using spreadsheets and have no tracking in place. Inventory management software, however, can pull this information together in a few clicks, so you can apply the right data to your EOQ formula. Also known as “optimum lot size,” economic order quantity refers to the number of units you should add to inventory with each purchase order. It is a well-known fact that the cost of ordering the inventory decreases with the increase in volume, because of economies of scale, but due to the increase in the size of the inventory, the carrying cost increases.

- The EOQ could potentially lead to shortages, and may not be the best way to calculate your order size if business is booming.

- This approach is also known as trial-and-error approach of determining economic order quantity.

- Flowspace’s platform also leverages historical sales data and other factors to help forecast future product needs and create a customized EOQ calculation.

- Unfortunately, ordering such a low quantity of bags at a time means you have to place more orders throughout the year, which means you pay the $100 purchasing fee more often.

- Economic order quantity (EOQ) is the the order size which minimizes the sum of carrying costs and ordering costs of a company’s inventories.

Products

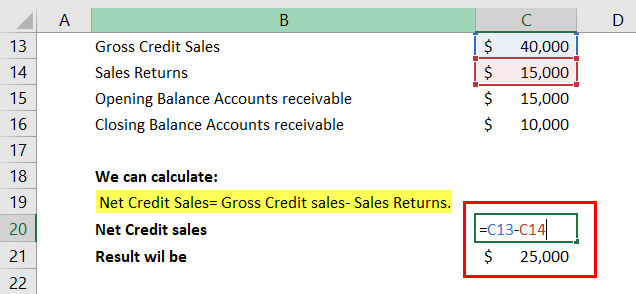

Economic order quantity (EOQ) is the ideal quantity of units a company should purchase to meet demand while minimizing inventory costs such as holding costs, shortage costs, and order costs. This production-scheduling model was developed in 1913 by Ford W. Harris and has been refined over time. The economic order quantity formula assumes that demand, ordering, and holding costs all remain constant. Economic order quantity (EOQ) is the order size that minimizes the sum of ordering and holding costs related to raw materials or merchandise inventories. In other words, it is the optimal inventory size that should be ordered with the supplier to minimize the total is bookkeeping hard annual inventory cost of the business. Other names used for economic order quantity are optimal order size and optimal order quantity.

Your reorder point is a predetermined level of inventory a business is comfortable reaching before it’s time to place a new order. This number is different for every item, as each item will have a unique EOQ. Using the EOQ for inventory planning can help you meet demand while maintaining a reasonable inventory balance. While at first glance over-ordering may seem like a safer move, you may be tying up too much of your cash in physical stock during periods of low demand.

What Is Economic Order Quantity (EOQ)?

- While the above formula may look complex, calculating economic order quantity is straightforward.

- Economic order quantity (EOQ) is a replenishment model designed to help you minimize your inventory costs, and overall, improve your inventory and supply chain management.

- If the company runs out of inventory, there is a shortage cost, which is the revenue lost because the company has insufficient inventory to fill an order.

- EOQ can be confusing when applied to products consumers only want occasionally or under certain circumstances.

A safety stock assessment involves analyzing the time it takes for the product to arrive from the vendor, the average demand for the product, your supply chain configuration, and your comfort level with running low. When you use the economic order quantity model can help you cut down on dead stock and obsolete or expired products. By calculating the optimal order quantity of each a r factoring definition why factor types of factoring item, you will be more likely to sell it well before its best-by date.

Here’s an overview of economic order quantity, why it matters, and how to calculate EOQ for your small business. One of the key features of Flowspace’s platform is real-time inventory visibility with our inventory management software. By providing instant visibility into stock levels and location, brands can avoid stockouts and ensure prompt and accurate fulfillment of orders—no guesswork needed. Plus, the platform sends alerts when inventory levels are low, empowering brands to reorder products before they run out. Economic order quantity is a calculation that is used to find the optimal order quantity for businesses, with the aim of minimising logistic costs, warehouse spaces and overstocks.

Examples of these costs include telephone charges, delivery charges, invoice verification expenses and payment processing expenses etc. The total ordering cost usually varies according to the frequency of placing orders. If your business has complex ordering needs, the EOQ model could still be an efficient way to cut costs—but we’d recommend using inventory management software to calculate your EOQ automatically. Get started by checking out our top-recommended inventory management platforms. Manufacturing costs can likewise fluctuate based on time of year, turnaround rate, and more.

The ideal order size to minimize costs and meet customer demand is slightly more than 28 pairs of jeans. EOQ is helpful in determining the ideal order size, so as to maintain a supply chain which is cost-effective. In this, a fixed quantity is ordered whenever the inventory level is down to a certain reorder point. It helps in the calculation of reorder point and reorder quantity, to facilitate immediate refilling of the inventory to avoid shortage. It means ABC needs to place a new purchase order to XYZ when its inventory level reaches 7,071 units. It will help the company to minimize the inventory cost, which includes purchasing cost, ordering cost, and holding cost.

While the EOQ formula is a valuable tool, it’s important to remember that it’s a simplification. In reality, real-life factors like lead times, order discounts, and safety stock requirements can influence your optimal order quantity. Additionally, the EOQ assumes constant demand and holding costs, which may not always be true.

When used properly, EOQ helps your business stock the perfect amount of inventory—enough to meet the demands of your customers. The rest of your cash can be saved for a rainy day, or injected into other areas of business, like sales, marketing, or human resources. Whatever the size of your organisation, having effective inventory management will help reduce costs and stockholding. Keeping the annual demand constant if for example the number of orders decreases, the ordering cost will also decrease but the holding cost will rise and vice versa.

The two most significant inventory management costs are ordering costs and carrying costs. Ordering costs are costs incurred on placing and receiving a new shipment of inventories. These include communication costs, transportation costs, transit insurance costs, inspection costs, accounting costs, etc. These include opportunity cost of money held-up in inventories, storage costs such as warehouse rent, insurance, spoilage costs, etc.