Insurance companies routinely use replacement costs to determine the value of an insured item. The practice of calculating a replacement cost is known as “replacement valuation.” Businesses with a large asset base may engage in replacement cost budgeting. Under this approach, they anticipate when their key assets are going to require replacement, and then set up a plan to set aside the necessary funds for them, so that they can be replaced in an orderly fashion. For example, a manufacturer of precision widgets knows that a widget lathe will wear out in three years, and so develops a plan for how to come up with its $30,000 expected replacement cost. When the lathe wears out, the manufacturer will have the money to buy a new one.

- It is important to note that the fair market value and replacement cost for a building may not be the same because they are different concepts.

- Replacement cost is the price that an entity would pay to replace an existing asset at current market prices with a similar asset.

- It is not necessary that the market value and replacement cost of a building are identical, as the two are distinctly different approaches to valuing a property using real estate data analytics.

- When depreciation is charged on historical cost, it will not match the cost of the replaced asset.

- Once an asset is purchased, the company determines a useful life for the asset and depreciates the asset’s cost over the useful life.

What is a replacement cost accounting?

Market value is in the eye of buyers and sellers, while replacement cost is the sum of all elements brought together to produce a physical property. In the example above, we have made the two total valuations identical, which is the ideal. Overhead and profit component are just two variables that can change the total cost approach valuation. They are distinctly different concepts that are estimated using different criteria. It is not necessary that the market value and replacement cost of a building are identical, as the two are distinctly different approaches to valuing a property using real estate data analytics.

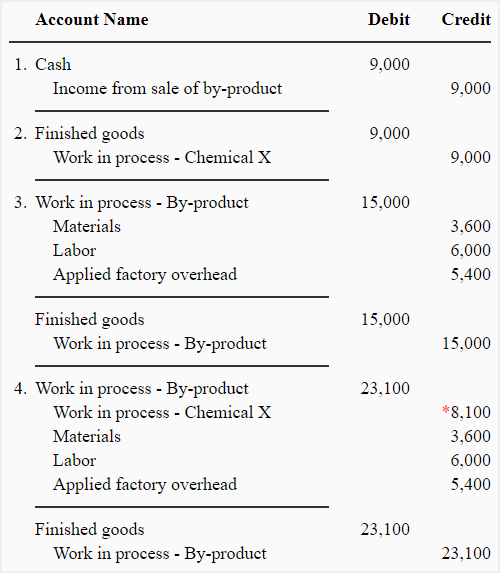

Journal Entries

Once an asset is purchased, the company determines a useful life for the asset and depreciates the asset’s cost over the useful life. Defining replacement cost as a method of estimating market value rather than a separate basis of value blurs the distinction between cost and value. This paper argues that market value assumptions do not hold in the case of the replacement cost method. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Depreciation and Replacement of Fixed Assets

It is found out by calculating the present value followed by its useful life. In business, a replacement cost is the cost of restoring or replacing an asset that has been sold or damaged. This may be different from the cash value of that asset, due to factors like depreciation and market fluctuations.

Differences between determining a property’s value and accurately estimating its replacement cost are worth comparing

With respect to the replacement cost method, it often ignores the unique attributes of the asset itself. Furthermore, the cost approach is of particular importance for the valuation of the workforce—a key component of a firm’s goodwill and a crucial input for the income approach, particularly when using the multi-period excess earnings method. This means that rca is more accurate when compared to cpp because it calculates Depreciation on the basis of current costs rather than historical costs.

Get in Touch With a Financial Advisor

Replacement Cost Accounting is an improvement over current purchase power parity (cpp). Cpp suffers from the problem that it does not consider the individual price index related to the particular assets of a company. The rca technique uses the index that is most directly relevant to the company’s individual assets and not the general price index. Replacement cost is calculated as the cost of the materials and labor to replace or restore damaged property to the quality and condition before it was damaged.

Such items that can be covered under this scheme include television, furniture, etc. When it comes to replacement cost for insurance, the schemes may not be available for a car insurance. However, for the rest, there is a possibility of protecting the items meant to be replaced in future against depreciation using a policy. It is important to note that the fair market value and replacement cost for a building may not be the same because they are different concepts.

This concept is important to businesses because most assets wear out and need to be replaced eventually. After 5-10 years, the vehicle will no longer work and will need to be retired and a new one will need to be purchased. Most likely the replacement will cost more than the price paid for the original vehicle. Another thing to keep in mind is that the replacement cost must include any other cost incurred for the new asset to be fully available and operational. The concept is also used in capital budgeting, when formulating estimates of the funding needed to replace existing assets as they wear out. A business might even set aside cash for several years prior to actually replacing a major asset, based on the amount of its estimated replacement cost.

When comparing market value to replacement cost, it is important to understand what both represent and what factors are considered in each circumstance. The market value and replacement cost of a building are not the same thing. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Replacement cost is a term referring to the amount of money a business must currently spend to replace an asset like a fixture, a machine, a vehicle, or an equipment, at current market prices. Sometimes referred to as a “replacement value,” a replacement cost may fluctuate, depending on factors such as the market value of components used to reconstruct or repurchase the asset and the expenses current portion of long term debt cpltd involved in preparing assets for use. Consider a manufacturing company, ABC Inc., that owns a fleet of delivery trucks used for transporting goods to customers. To assess the current value of its fleet, ABC Inc. decides to calculate the replacement cost of its trucks based on current market prices. The replacement cost technique is beneficial for those who can take advantage of the same.